Market Commentary

The first quarter of 2025 has reinforced several macro themes we have discussed in our Q4 letter: interest rates remain too high to support broad economic expansion, the Fed’s ability to ease is constrained, and a post-election cyclical upturn has yet to materialize. Market leadership has become increasingly narrow, and macro factors continue to dominate near-term equity market moves, often overshadowing individual company fundamentals.

Periods like this test the limits of bottom-up investing. When macro shocks or sentiment shifts dominate, capital flows tend to reward perceived “safer” factors (e.g., consumer staples, healthcare, and large-cap dividend payers). This dynamic can distort performance attribution, making it critical for investors to distinguish between factor exposure and genuine alpha.

Recent volatility and rotation away from growth sectors, particularly small- and mid-cap technology stocks, underscore the risks of crowding into safety. As fears of a recession have escalated, capital has flowed defensively, creating dislocations in valuations across small mid cap technology.

We remain constructive on enterprise software and find the valuations quite attractive. It continues to represent one of the most attractive segments of the economy, combining high gross margins, recurring revenue, and scalable unit economics. Moreover, private equity demand and long-term digital transformation secular trends, now accelerated by AI adoption, continue to provide durable tailwinds and downside support.

AI Narrative

We believe the AI narrative is entering a new phase. While last couple years, the market enthusiasm has centered on infrastructure, we see future value accruing to specific use cases and software applications that can drive real productivity gains. In our experience, value mostly end up migrating towards the ‘end-point of delivery’ because that’s where the real ROI can be measured and delivered.

We are seeing strong undercurrents of widespread adoption of agentic AI across enterprises in addition to continued consumer adoption. The pace of adoption has been exceptional and that itself says something about the staying power of this technology in the long run. As the cost of infrastructure likely comes down due to innovations (such as shown by DeepSeek and others), we believe application adoption can drastically improve, and we see momentum is definitely building across specific use cases and verticals.

AI is certainly one of the most interesting technologies of the current times, and we have written about AI in prior letters in detail. We love AI as a tool and we do think it will have huge ramifications in the long run. Our nuanced reservation has been that the value from AI will likely not really accrue to the infrastructure layer in the long run, while the public markets have attributed most of the value towards infrastructure (chips, hardware, servers, power, datacenters etc.), which we believe created a hype and overvaluation.

In the medium-term, we believe that the real AI benefit will show up in terms of consumer/enterprise applications that are built on top of that infrastructure, and that’s where the majority of the value should accrue. It has happened on the consumer front, but not really at the enterprise layer, because the implementations and adoptions are just starting. The important point is that the wave has started and should pick up pace over the next few years. The number of projects, the amount of mindshare, the extent of investments going into AI, as well as the adoption numbers from both consumers, industrial, and enterprise users alike, are solid indicators that AI will continue to remain an important part of technology stack.

Most technology companies are already incorporating AI in their products / features and offering it as a value-add to their customers. There will be new companies that might leverage use-cases that are AI-first and disrupt some incumbents (just like it happened slowly in any prior technology wave), but the pace of adoption and mindshare devoted to AI by all companies indicate that it remains a fair playground for winners and losers.

Tariff Deals

On the topic of tariffs and recent market turmoil, we do not believe the global order is on the verge of breaking down and we think US economy will continue to be the place to be. While geopolitical tensions and tariff risks remain elevated, history suggests that economies adapt, negotiations resume, and markets eventually recalibrate. Much of the fear reflected in headlines is already embedded in asset prices. As such, we view this period as a time to lean into core competencies, and the turmoil being more of a temporary phenomenon rather than a harbinger of some dramatically changing world order.

We believe that most countries (and companies) simply want to carry on business regardless of whatever the new parameters are, hence, once there is increased clarity, business tends to be quite resilient to absorb short term fluctuations. Many of the foreign countries are also not arriving at this juncture from a very high starting point in their GDP growth (as we highlighted in the last letter). Hence, most of the foreign leaders are unlikely to take a dramatic hard stance of ‘not working together’ as it goes against improving growth of their core constituencies. The rational thought of most world leaders is keep promises made to ‘their own populations’ and focus on the well-being of their people, and hence, they are unlikely to make this an agenda to initiate a fight, and will like to work something out. Even in the case of the US, President Trump also wants to work something out to showcase wins. Thus, we believe there is desire from all sides to work out an arrangement to move forward.

Another point to note is that a basic human tendency is trying to resolve things quickly. Most people are not comfortable staying in a prolonged period of uncertainty. There is a parallel in the world of physics, which is that complex systems tend to arrive relatively quickly to a local minimization of energy, termed as ‘local minima’ (even if that may be disadvantaged position relative to the “global minima”). What this means in the current political landscape is that people will want to work something out to achieve a ‘local minima’, rather than take a hard stance to find the best ‘global minima’.

Hence, our assessment is that although it might appear that there is a lot of noise and it might seem that the world order is about to break down, it is incredibly hard to derail the global world order. Yes, it is likely that we might be undergoing a rather substantial change of direction in the existing world order, but we think that it takes decades (rather than a couple months) for any sustainable meaningful change to emerge.

In addition, we have always maintained that the world is becoming a lot more connected with real time dissemination of information, which has the ability to change the directionality of investment. This implies that if there is a reversal of policies or sentiment, most of the world will likely bake that in rather quickly. It is relatively easy to forget what just happened and move on to the next new thing, as most people are very busy with large number of competing priorities. Hence, the long-term lingering effects are unlikely to materialize.

As of today, we think it is unlikely that we are going to go into a recession if cooler heads prevail (our base case) and the damage control can be done quickly. US consumers and businesses have learned to be very resilient and can respond quickly to control costs and respond quickly to any such macro shocks.

Exciting Time to Invest in Software & Technology

Today’s environment presents a compelling entry point into software and technology. Valuations across much of the sector have reset meaningfully, many to levels below their 2022 lows when inflation (and interest rates) spiked, despite continued structural growth, massive improvements in profitability, and long-term value creation potential. Times like these create optimal entry points for fundamental investors to look beyond these macro-induced gyrations.

IT and software remains the strongest secular growth area in the economy, underpinned by mission-critical products, high recurring revenue, and low capital intensity. These companies often operate with 70–80%+ gross margins, providing substantial operating leverage even in uncertain macro conditions. AI adoption is also beginning to transition from hype to utility. While markets initially over-indexed on infrastructure providers, we believe the next wave of value will accrue to software applications that drive productivity, workflow automation, and domain-specific intelligence. Most enterprises are just beginning to integrate AI into their operations, and the early signs of adoption across sectors suggest sustained momentum. Additionally, the depth of private equity capital targeting the software space adds further support. With large amount of dry powder, private market investors continue to seek scalable, high-quality assets—and public software companies are increasingly within scope due to valuation resets and scarcity of large-scale private targets.

Taken together, these dynamics create a rare combination of long-term growth visibility, near-term valuation support, and secular demand tailwinds, make this a particularly exciting time for patient, fundamental technology investors.

Assessing The Recent Decline in Enterprise Software Multiples

So far, 2025 has been a very poor environment for enterprise software. Valuations have compressed meaningfully and the pace of decline in stock prices has been rather uncomfortable. There have been three main reasons of this rapid decline:

Deterioration/Deceleration of Fundamentals (Perception or Real):

This was driven either due to macro weakness coming from tariffs or DOGE, or company specific factors, the revenue growth rate or the incremental margin expectations are declining.

Much of this deceleration seem to be now priced in with average software stock down 32% in last two months. In fact, tariffs could in fact be a positive catalyst for some software companies both from a fundamental standpoint (for companies supporting supply chains, trade, tax compliance, etc.) as well as a factor standpoint (for investors seeking growth stability).

AI Overhang:

There is a narrative around agentic AI displacing software companies because AI agents can directly replace the business logic of most enterprise software applications.

Realistically, AI can be an accelerant for some software companies, especially because to achieve the promises of agentic AI, companies must have the appropriate architecture, integrations into existing stack, deep customer relationships and access to customer data.

Technical Factors

During distress periods, investors prefer larger cap stable companies, vs. small-mid cap; investors also transition to higher free cash flow generating companies and more value-oriented companies vs. growth. Software typically has higher growth and has high stock compensation, which may screen poorly during a potential recessionary/slowdown period.

Our view is that much of that “perceived safety rotation” has already happened as the valuation has compressed significantly.

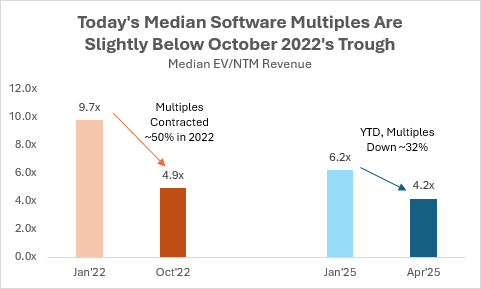

Just to highlight how severe the current drawdown has been - in 2022, software multiples were down about 50% in 10 months, vs we are already down more than 32% in just about 2 months in 2025. This is despite the current year’s starting point already being ~33% below where things were in 2022.

Enterprise Software Valuations Are Now Below 2022’s Trough, Despite Significant Progress in Profitability

Valuation is an important criterion to decide whether there is appropriate reward for taking the macro risk in buying a company today. We do think valuations have come down significantly across the board in software and are even lower than the lows in 2022, almost entirely on perception of a slowdown (in 2022, it was driven by a substantive shift in rates rising from 0% to mid-single digits).

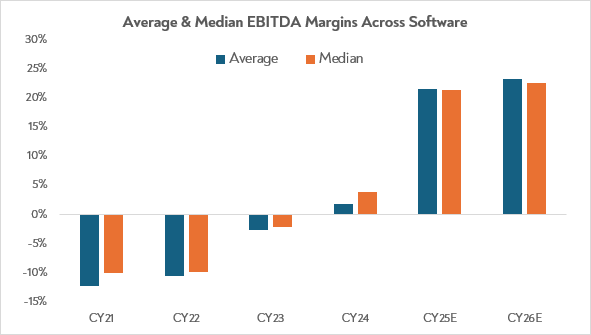

The overall software valuation multiple has now come down to ~4x revenue (which is 20% lower than the bottom in 2022, and almost half of the valuations pre-COVID). Importantly, the companies we own today are in much better shape structurally as many of the excesses of the ‘growth at all’ costs era have begun to dissipate. In 2022, the median EBITDA margin within software companies was -10%, which compares to 2025’s median EBITDA margin of +20%.

Hence, we do believe current valuations offer an attractive entry point. Three catalysts can drive the valuations up:

- Macro fears might not materialize

- AI might actually be a positive catalyst (for some companies) instead of the fear that AI will disrupt these businesses

- Companies can drive much faster cash flow generation

It is a very exciting time to be in the world of technology and we believe tremendous value can be generated not just in the small pockets of “early stage AI” or “large cap consensus winners”, but rather by sifting through a wide array of interesting companies with idiosyncratic characteristics.